- Pudgy Ponders: One Pudgy Penguin's view on startups, life and web 3

- Posts

- Pudgy Ponders: Degens vs Investors

Pudgy Ponders: Degens vs Investors

Has web 3 glorified being a degen?

Welcome back to Pudgy Ponders, where Pudgy Penguin Hutch (@lovingNFTs) unpacks life and web 3’s big questions with a side of wit, tartar sauce, and a sprinkle of wisdom.

Today, we’re diving into a topic that’s been on my mind for a while, and admittedly I’ve struggled with my own clarity here at times as a former trader and in web 3.

So let’s dive in….

Degens vs Investors.

What are you? Does it matter? Can we be both?

The line can feel blurry, especially when you’re winning and making money, we (myself included) sometimes mistakenly think we’re investing gurus when we actually just got lucky.

On the flip side, from experience, I can tell you, very few things feel worse than ape’ing into a project, getting rugged, and losing more money than you were prepared to lose!

Trust me (bro), I’ve been there.

Before we dive in, I want to spend a moment talking about being a degen.

In crypto, being a degen has become synonymous with ape’ing into trades, grinding in the trenches, and often times, strangely, it’s taken or given as a compliment.

Weird.

Being irresponsible and taking extreme risks for huge potential returns rarely works out, yet that’s not how the culture of web 3 has treated being a degen.

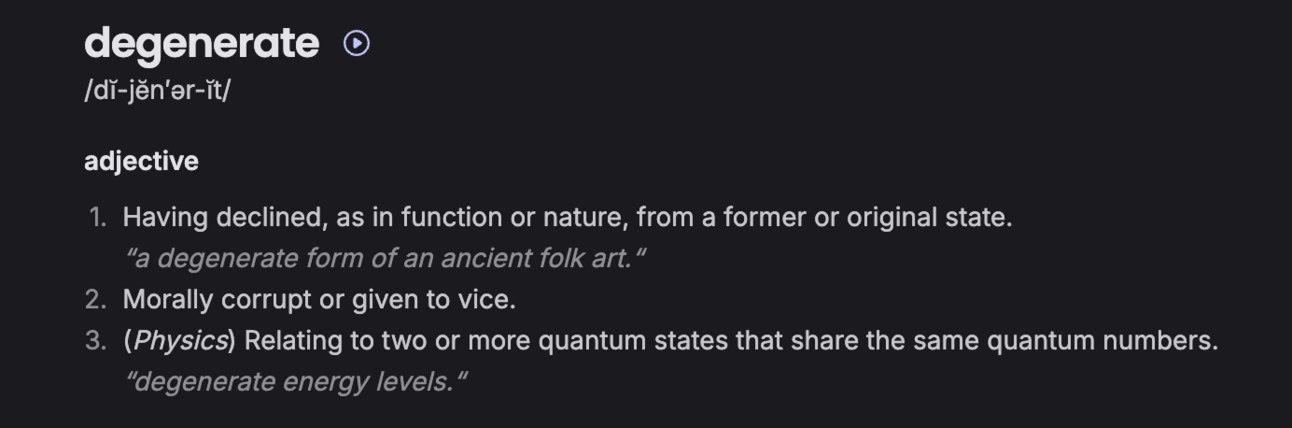

Rather than being offended, for the most part, web 3 has warmly embraced the term degen despite what it actually means [degen is a noun, short for - degenerate]. See the definition of a degenerate below (often used with being a “degenerate gambler”)

Degen or Investor?

Let’s break it down with some clear but not always the case markers to help look at what side of the line certain behaviors are usually on.

And I say usually, because there are always exceptions based on people, markets, skills, outcomes, wealth, and mental health.

Did Michael Jordan the GOAT of basketball have a gambling problem? Depends how you look at it, Jordan was able to gamble vast amounts of money (and lose), given his wealth without affecting his lifestyle. I’d lean on the side that MJ did not have a gambling problem.

As a reminder, the theme of this blog is to reflect on questions, to improve our lives and outcomes, not to pass judgment.

At its core, investing is about building wealth over time through calculated decisions based on research, strategy, and patience. Gambling or being a degen, on the other hand, is about chasing quick wins, often driven by emotion, hype, impulse, or sheer luck. Both involve risk, but the mindset, approach, and outcomes differ wildly. Here are five key ways to tell if you’re investing or rolling the dice.

Are You Researching or Reacting?

Investing starts with homework. Whether it’s analyzing a company’s financials, understanding market trends, tools like that, or studying a digital asset’s historical performance, investors dig into data to make informed choices. For example, if you’re eyeing a stock, you might look at its price-to-earnings ratio, revenue growth, or industry outlook. If you’re buying real estate, you’d check local market conditions and property values. The same can be said for memecoins and NFT projects. The more homework you do, generally the more informed decision you can make. Even the best intentioned research loses money from time to time.

Gambling or being a degen, by contrast, often skips the research phase. If you’re throwing money into a memecoin because a friend said it’s “going to 100x” or it’s filling up your timeline on X and you’re feeling FOMO, you’re reacting, not reasoning. Sometimes the biggest misnomer is when you are making money, you trick yourself into thinking you are investing, smart, and doing research. A massive bull market can fool you just the same. I was trading commodities back in the 2000s in a massive bull market and had to remind myself many times, the volatility can work in both directions.

Ask yourself: Do I understand what I’m putting my money into? Could I explain it to an 8 year old and an 80 year old? If the answer is “not really,” that’s okay, but you’re probably closer to the degen in the casino than being an investor.

What’s Your Time Horizon

Investors play the long game. They’re thinking years, even decades, aiming for steady growth through compound interest or asset appreciation. Think retirement accounts, diversified portfolios, or buying a rental property to generate passive income over time. A well thoughtout crypto and NFT strategy can also fit in this category if you’re thoughtful about it and can think out beyond 12-24 months, which yes I know, feels like centuries in crypto.

Gamblers want instant gratification. Day trading with no strategy, jumping into “hot” projects, or betting on sub $100k meme coins often screams short-term thrill-seeking. If your plan is to “get rich quick” and cash out by next week, you’re gambling. Investments grow like oak trees; gambles are more like slot machine spins. It’s okay to have both long and short term time horizons, grow slow bags and your hope to hit 100x lottery tickets, you will benefit from an awareness and a strategy around your time horizon buckets.

How are You Managing Risk?

A hallmark of investing is managing risk. Investors build portfolios with a mix of assets—stocks, bonds, real estate, bitcoin, defi tokens, and maybe some crypto ETFs—to weather market ups and downs. Diversification isn’t about avoiding risk entirely; it’s about managing it smartly.

Ape’ing in or being a degen in web 3 usually involves betting too much, on what’s often a poorly researched trade or project. “This has to work out because people on the internet believe in it blindly” or “I really need this to work out.” If you’re dumping more money than you can afford to lose without affecting your lifestyle (what tradefi calls “risk capital”) into a single project, a single NFT, or crypto as a whole, you’re buying a lottery ticket and hoping for a jackpot. In short, your risk management is suspect.

How is your Mental Health?

Investing requires discipline, education, and a plan. With an investing mindset, it should help create peace of mind and conviction in what you are doing. Whether you are winning or losing, you are confident and less rattled, because you took a well-calculated strategic approach. You size your bets, and have a plan of action what to do when a market fluctuate before it happens. When markets fluctuate, as they do in crypto, investors stick to their strategy, whether that’s to buy the dip, HODL, or sell, tuning out the short-term noise is key to capitalize on what maybe the greatest financial opportunity of our lifetimes.

Gambling on the other hand, is an emotional rollercoaster. Your highs are high and your lows are really painful and affect your moods as you move through the world. In some cases you could be mistaken for someone with a drug problem or bi-polar if you’re not sizing your bets correctly, playing with money you cannot afford to lose, and don’t have strong emotional regulation and control. If you’re buying because you’re hyped up or selling because you’re scared, you’re letting emotions steer and you maybe playing with too much money you can’t afford to lose.

Leverage is amplifies wins, loses, anxiety, nervousness, and risk. Using stop losses and set points to take profits can reduce the effects of leverage, however, only very experienced traders should be using leverage when they trade - and even then - the outcomes can be a disaster.

Do You Have a Plan?

Smart investors have a roadmap. They set targets and allocate their money strategically, and adjust as needed. They know why they’re investing and when they are gambling.

Degens ape in blindly.

When social media amplifies content screaming “This coin is the future!” or “Crash incoming!” it can can push you to act impulsively if you don’t have a well thought through (and in the best case scenarios, a well written) plan. If you’re checking your portfolio 20 times a day and sweating every price tick, you’re probably a degen. If you’re having trouble sleeping or focusing, those are serious signs you’re attention is misguided by your gambling, which you may still think is investing. I’m not saying all gambling is bad, but you should be intentional with separating your gambling and investing funds. For most people, your gambling funds should represent less than 5-10% of your total funds though that percentage can vary widely based on your trading experience, income, age, and savings.

Where do you get your information?

If your “strategy” is based on a YouTube guru’s prediction or feeling that “this is the one,” you’re not investing, you’re guessing. Keep in mind the content creators are optimizing for eyeballs, not your P&L, and often times make sensationalized claims while making money from ad revenue rather than the projects they are hyping (which they may have been given free tokens to promote). And I’m not saying all online content is bad and misleading, just be sure you know the difference between educators, people who are shilling their bags, and content creators. That said, there are a lot of brilliant people on the internet and X, so being intentional about who you follow is important.

A plan doesn’t and curated timeline doesn’t guarantee success, but it gives you a framework. Without one, you’re blindly following your implus

The Gray Area

Sometimes, the line between investing and gambling isn’t crystal clear. That’s okay. The same way venture capital, startup investments can feel like a blend of both so can some opportunities in crypto and NFTs. High-risk investments (memecoins, newly launched NFTs) can be part of a portfolio, but they’re still grounded in research and strategy, not whim. The key is balance and intent. If your high-risk move is a small, calculated part of a broader plan, it’s investing. If it’s your whole game, it’s a gamble.

🐧 Final Waddle of Wisdom

Every scenario is different and there’s more to “is it a problem” that your P&L. How does it impact your life? How much of your attention is it consuming? What other parts of your life are thriving or suffering because of your gambling? How is your mental health.

Investing is about informed decisions, long-term growth, and managing risk. Gambling or being a degen is about chasing thrills, betting on luck, and hoping for a massive quick wins. Before you put your money down, pause and reflect. Are you building wealth or chasing a dopamine rush? Do your homework, diversify, plan, and keep your emotions in check. Your future self will thank you.

If you are not sure, that’s perfectly okay. Consider talking to those closest to you, looking at your P&L, keeping a trade journal, detoxing from technology for a week, writing, or spending time in nature, to hear your thoughts and increase your self-awareness.

That’s it for this Pudgy Ponders post. What’s your take—have you ever caught yourself gambling when you thought you were investing? Drop your thoughts below or on X, and let’s keep the conversation going. Until next time, stay curious and keep pondering!

-Hutch @lovingNFTs